We have the question come in frequently, “Do All FHA loans require Mortgage Insurance?” …And if so for how long. The short answer is “Yes” Mortgage Insurance is required on All FHA loans. This is effective for all mortgages with FHA case numbers assigned on or after June 3, 2013.

Although we are not Mortgage Brokers, we get questions like this from our clients when we help them buy and sell homes, so we understand why this question gets asked. We realize the real question is “What’s the best lender or loan to keep my monthly payments as low as possible?”

FHA loans are great if you don’t have much down payment money and you are not otherwise eligible for a VA loan. FHA loans require only a 3.5% down payment compared to most Conventional loans that will require a 5% down payment. There is even an FHA insured loan offered through El Paso County Colorado where you can get FREE down payment money, effectively 0% down. More to be posted on the Wish Property Group blog on that topic later.

FHA loans require a 620 credit score by all lenders that submit loans for review to the FHA with an Automated Underwriting System (AUS). Many lenders we work with can accept as low as a 580 credit score for FHA and VA loans but that requires Manual Underwriting by the lender and you typically have to have what they call a “clean file”.

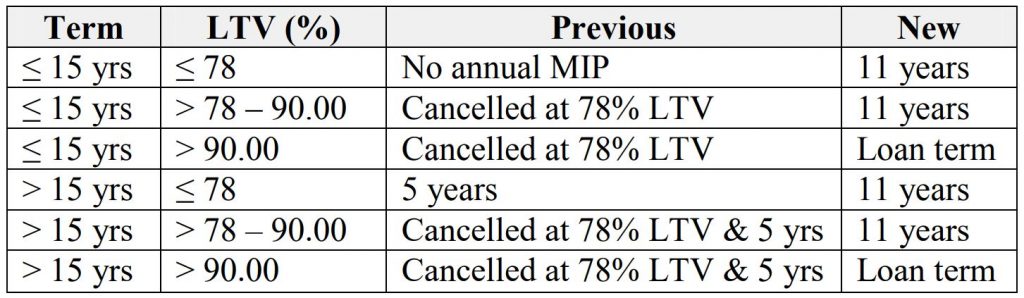

Most people fall in to the category where Mortgage Insurance Premium (MIP) is required for the life of the loan in that most people get FHA loans with a term greater than 15 years and have a LTV (Loan To Value) greater than 90%. For some FHA loans that meet the criteria as illustrated in the table below, the MIP requirement may only be for the first 11 years of the loan term.

This change to the FHA insured loan requirements regarding MIP was made effective as of June 3, 2013 in an effort for FHA to strengthen its Mutual Mortgage Insurance Fund.

For loans with FHA case numbers assigned on or after June 3, 2013, FHA will collect the annual MIP for the maximum duration as illustrated in the table below:

The above table and best reference to this question may be found at the source per HUDs Mortgagee Letter 2013-04 http://portal.hud.gov/hudportal/documents/huddoc?id=13-04ml.pdf